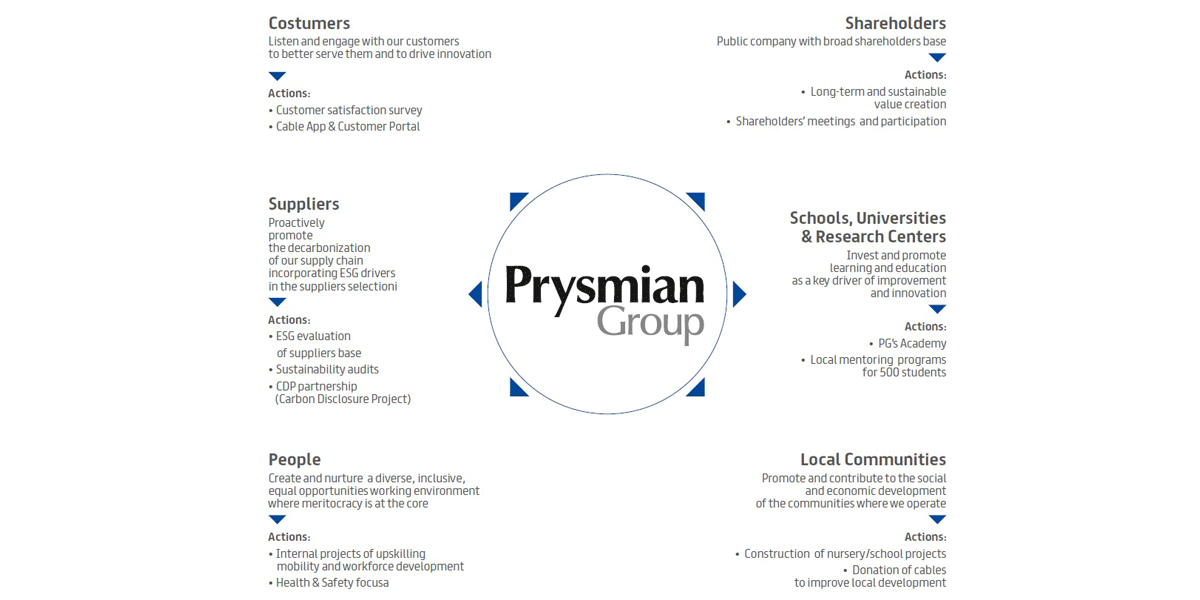

Events dedicated to dialogue with those Stakeholders whose interests are, or might be, impacted by our activities, are an integral part of the Group’s growth strategy and provide an effective communications channel. The purpose of these initiatives is to:

• identify ideas for improvements that lead to product and process innovation;

• map the impacts generated and felt by the Group, in order to ensure better management of reputational and other risks;

• inform, engage and raise the awareness of Stakeholders regarding various aspects of importance to the Group and the societies in which it operates;

• identify the needs, problems and expectations of Stakeholders in order to embed them in the Group’s strategy and develop a relationship based on trust and transparency.

These engagement initiatives are pursued in various ways and via multiple channels, to identify:

• the main impacts (positive and/or negative, real and/or potential) of the Group’s activities throughout the Prysmian value chain, including additional new actions that the Group could implement to contribute to sustainable development, considering their magnitude and probability of occurrence;

• the major impacts felt by the Group with reference to two financial parameters - Free Cash Flow and Adjusted EBITDA - considering two time horizons – short-medium term (3 years) and long term (by 2030);

• to assess and prioritize the impacts;

• to cluster the impacts into material topics and their subsequent prioritisation via surveys and one-on-one interviews;

• to assess, via interactive workshops, their perception of the Group’s initiatives and activities regarding the targets of the UN Sustainable Development Goals (SDGs).

The main external Stakeholder Engagement activities were:

• Prysmian Group Sustainability Week, organized by the Group for the first time and held on a virtual basis in order to reach a global target

• Topic workshops;

• External Stakeholder Survey;

• Interviews with major investors.

The main internal Stakeholder Engagement activities were:

• Interviews with Top Executives;

• Senior Leaders Survey;

• Sustainability Steering Committee.