Outstanding Results: Sound margins Expansion & Strong Cash Generation

Well on track to deliver on mid-term targets, in line with the “Connect, to lead” strategy

- REMARKABLE PERFORMANCE IN 2023:

- Adj Ebitda at €1,628M (+9.4% vs 2022), with improving margins at 10.6% (9.3% in 2022)

- Group net profit increase to €529M (€504M in 2022)

- Strong cash generation with Free Cash Flow at €724M (+29.5% vs 2022)

- RECORD BACKLOG IN TRANSMISSION OF €18 BILLION

- INCREASED 2030 EMISSION REDUCTION AMBITION (SCOPE 1&2) TO 55-60% FROM 47%1

- PROPOSED DIVIDEND INCREASE TO €0.70 PER SHARE (+16.7% VS 2022)

- FY 2024 OUTLOOK:

- Adj Ebitda expected in the range of €1,575M–€1,675M

- Free Cash Flow expected in the range of €675M–€775M

- Scope 1&2 GHG emission reduction of 36% and Scope 3 reduction of 13% vs 2019

Valerio Battista, Chief Executive Officer (CEO), commented: “The sound margins expansion and the strong cash generation achieved in 2023 confirmed Prysmian’s resilience and the market leading position, thanks to our complete and balanced portfolio well exposed to the structural trends of the electrification and the energy transition. In a challenging environment, we achieved once again an excellent performance and ensured value creation to all our stakeholders. 2023 was my last year as CEO of Prysmian, and I am incredibly proud of the company we have built over the past 20 years, a strong organisation that is leading the industry, and that has the technology and resources to capitalize on exciting market opportunities and breaking new records year after year”

Massimo Battaini, CEO-designate, stated: “At our Capital Markets Day we laid out our “Connect, to Lead” strategy aimed at capitalizing on the Group’s leading market position to seize the opportunities presented by current market trends. We have reshaped our business into four new segments, effective from 1st January 2024 to better capture these opportunities. We continue to be at the forefront of innovation, thanks to our unparalleled R&D capabilities and our deep understanding of the evolving market dynamics. In light of our solid backlog across all segments, we are confident of achieving 2024 targets and are well on track to deliver the mid-term targets outlined at the CMD. I look forward to driving this company and our great team to the next level and to strengthening our role as global cabling solution provider leading the Energy Transition and Digital Transformation”.

1-47% GHG emission reduction target approved by SBTi in June 2023. The range 55-60% is the new target proposed by Prysmian in line with the trajectory to net zero at 2035.

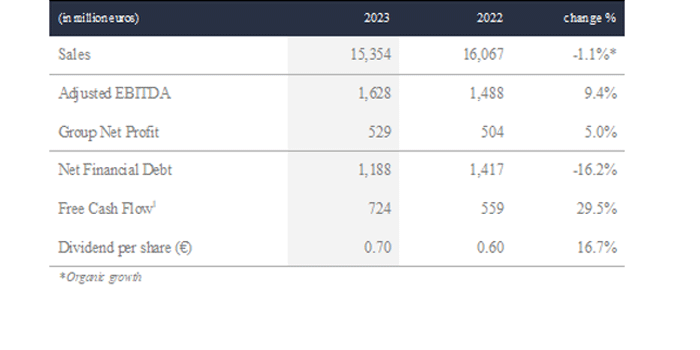

FINANCIAL HIGHLIGHTS

The Board of Directors of Prysmian S.p.A. approved the Group’s consolidated results for 20233.

Group Sales amounted to €15,354 million, with a slightly negative organic growth of -1.1% compared to 2022. The Projects Business reported a double-digit organic growth (+15.3%) thanks to a consistent execution of interconnection and offshore wind farm projects and projects with better margins. Sales in the Energy Business continue to benefit from the growth drivers of the energy transition: the expansion and upgrade of power grids, the energy generation from renewable sources, and the development of electric mobility and clouding. Overall, the Energy Business recorded a -1.3% organic growth, with a positive organic growth of +1.7% in the Industrial & Network Components. Volumes in the Telecom Business sharply declined in the second part of the year, mainly due to the US market downtrend.

Adjusted EBITDA rose by 9.4% to €1,628 million, with significantly improving margins at 10.6% compared to 9.3% in 2022. Strong improvement in the Projects Business with adj. EBITDA up 23.5% at €300 million thanks to the smooth execution and the improved project margins. The Energy Business margins improved significantly too (at 10.5% vs 8.1% in 2022), driven by higher profitability in power distribution and in particular in Industrial & Network Components, where the adj. EBITDA rose to €361 million (+43.2% vs 2022). A sharp market decline, especially in the US, negatively impacted the Telecom Business, with adj. EBITDA down to €140 million vs €271 in 2022. Q4 was particularly low, affected also by negative one-offs on top of the normal business seasonality.

EBITDA amounted to €1,485 million (€1,387 million in 2022), including net expenses for company reorganisations, non-recurring expenses and other non-operating expenses totalling €143 million (€101 million in 2022).

Net profit increased by 7.5% to €547 million (€509 in 2022). Net profit attributable to owners of the parent company amounted to €529 million (€504 million in 2022). This result is particularly positive taking into account the negative impacts of the €168 million impairment of the investment in Yangtze Optical Fiber (YOFC) and the €42 million impairment of fiber plant in Battipaglia (Italy).

Free Cash Flow2 amounted to €724 million, up by 29.5% (€559 million for 2022), well above the upper part of the guidance (€550-650 million).

Net Financial Debt fell sharply to €1,188 million at year-end (€1,417 million at 31 December 2022), driven by strong cash flow generation.

2FCF excluding Acquisitions & Disposals and Antitrust impact

3The Consolidated Financial Statements and Draft Separate Financial Statements are currently still being audited.

BUSINESS OVERVIEW

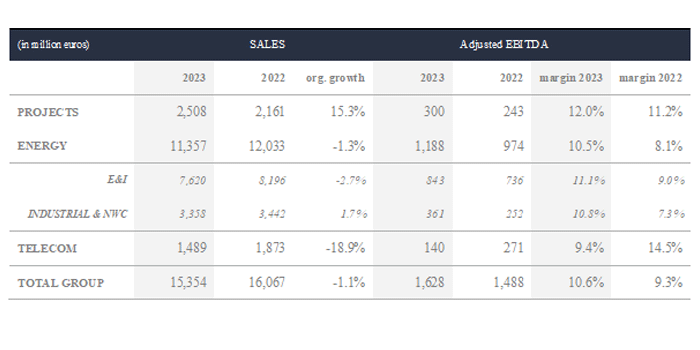

FY PERFORMANCE BY BUSINESS

PROJECTS

Consistent execution and improved projects’ margin drove solid results growth. Sales amounted to €2,508 million, with a strong +15.3% organic growth. Adjusted EBITDA leapt to €300 million (+23.5% vs 2022) with improving margins to 12.0% (11.2% in 2022).

The Group successfully completed the Vineyard Wind 1 project, the first utility-scale offshore wind farm in the US, and the record Viking Link, the world’s longest onshore and offshore HVDC interconnector linking the power grids of the UK and Denmark. In the High Voltage Underground, the Group continued to produce the German Corridors cables in line with the plan and expect to start installation later this year.

In 2023, Prysmian acquired over €13 billion of new projects, bringing the total order book to approx. €20 billion (backlog + orders with solid commitment), increasing further the visibility on future performance. In February 2024, the Group received the Notice to Proceed for Amprion Frame Agreement and EGL 2 (projects awarded in 2023), bringing the total backlog up to approx. €18 billion.

ENERGY

Energy & Infrastructure

Sales in Energy & Infrastructure totalled €7,620 million with a -2.7% organic growth vs. 2022. Adj. EBITDA increased by 14.6% to €843 million (€736 million in 2022) with a strong margin improvement (11.1% in 2023 compared to 9.0% in 2022). Power Distribution and Overhead Lines recorded sustained growth and margins uplift driven by structural trends (grid hardening, renewables), while the construction cable business experienced volume softening and prices normalisation in the US, in line with expectations.

Industrial & Network Components

Sales of Industrial & Network Components amounted to €3,358 million with a positive organic growth of 1.7% compared to 2022. Renewables continued to grow double-digit YoY. Adj. EBITDA grew by 43.2% to €361 million (€252 million in 2022) with sound margins expansion at 10.8% compared to 7.3% in 2022. Profitability improved overall across all applications, in particular in OEM and Renewables.

TELECOM

Telecom sales declined to €1,489 million from 1,873 million in 2022 with a -18.9% organic growth. Adj. EBITDA was €140 million (€271 million in 2022), with margins declining to 9.4% compared to 14.5% in 2022. Sales recorded a volume slowdown particularly in the second part of the year, mainly driven by the US market. Performance in Q4 was further affected by negative one-offs, on top of the normal business seasonality. The contribution from YOFC also was lower in 2023 at €27 million, down from €40 million of the previous year. The long-term growth drivers for the Telecom Business remain strong driven by massive data growth as well as the increase of FTTH, 5G coverage, datacentres and IoT. The Group is well positioned to seize the opportunities offered by digitalisation.

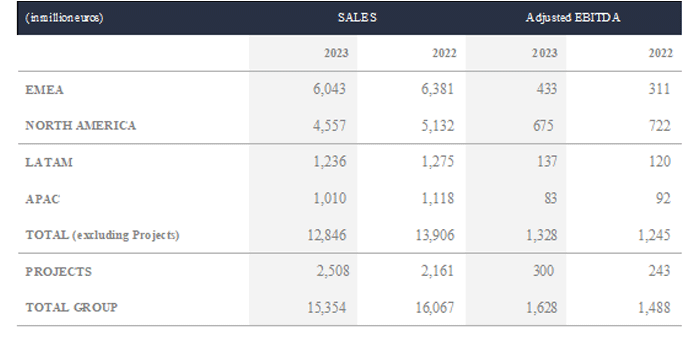

PERFORMANCE BY GEOGRAPHICAL AREA4

Sales in EMEA amounted to €6,043 million with a -1.7% organic growth. Strong adj. EBITDA increase of 39.2% to €433 million (€311 million in 2022) with sound margin expansion at 7.2% (4.9% in 2022), thanks to the positive performance of the Energy Business, in particular Power Distribution and OEM & Renewables.

In North America sales totalled €4,557 million, with negative organic growth of -5.9%. Adj. EBITDA was €675 million (€722 million in 2022), with improving margins at 14.8% compared to 14.1% in 2022. The Telecom Business decline and ongoing price softening in T&I, were fully offset by the strong performance of Power Distribution & Overhead Lines. Results were partly impacted by an adverse FX headwind (€22 million).

Sales in LATAM declined slightly to €1,236 million vs €1,275 in 2022, with negative organic growth of -6.0%. Adj. EBITDA increased to €137 million (€120 million in 2022) with solid margin improvement to 11.0% compared to 9.4% in 2022, mainly driven by T&I.

In Asia Pacific sales amounted to €1,010 million (-2.3% organic growth). Adj. EBITDA was €83 million (€92 million in 2022), affected by the lower contribution from YOFC (€13 million). Adj. EBITDA margins were stable at 8.2%.

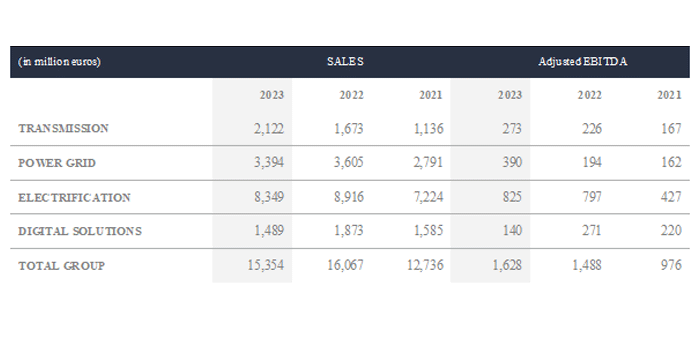

NEW SEGMENT REPORTING

As outlined in the Capital Markets Day, Prysmian reshapes its business into four new segments from the existing three:

- Transmission, including the Submarine Power and the Land HVDC business units, currently belonging to the Projects segment;

- Power Grid, including HVAC business unit, also previously in Projects, and Power Distribution and Overhead Lines, currently in the Energy segment;

- Electrification, including Industrial & Construction (former Trade & Installer) and Specialties (formerly in Industrial & NWC), currently in the Energy segment;

- Digital Solutions, the current Telecom segment, including the following business units: Fiber and Optical Cables, Connectivity, Multimedia & Inside Plant cables (MMS).

The new business segmentation reporting will start from Q1 2024, effective as of January 1, 2024. For ease of reference, the main financial results posted in the last three years are disclosed below according to the new segmentation: