Outlook

The cable industry is increasingly strategic due to long-term market trends which require resilient, high-performing, sustainable and innovative cable solutions: increased renewable generation, growing electricity demand, enhanced power grids, massive data growth. In this context, Prysmian is uniquely positioned to seize current market trends which require resilient, high-performing, sustainable and innovative cable solutions.

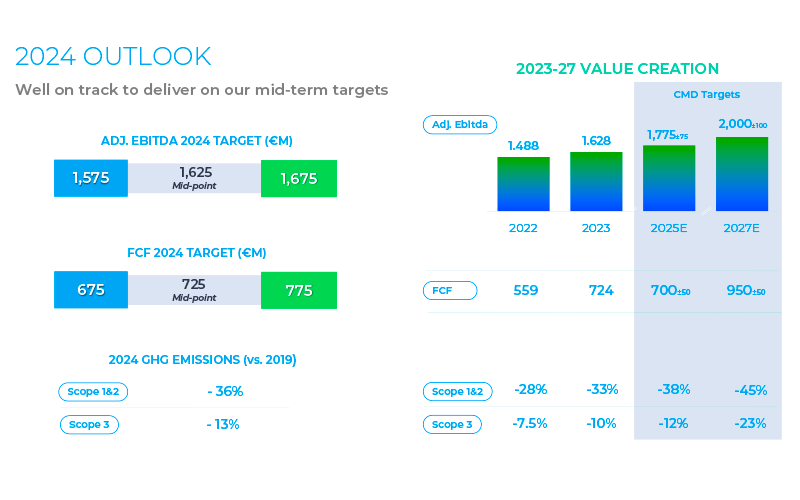

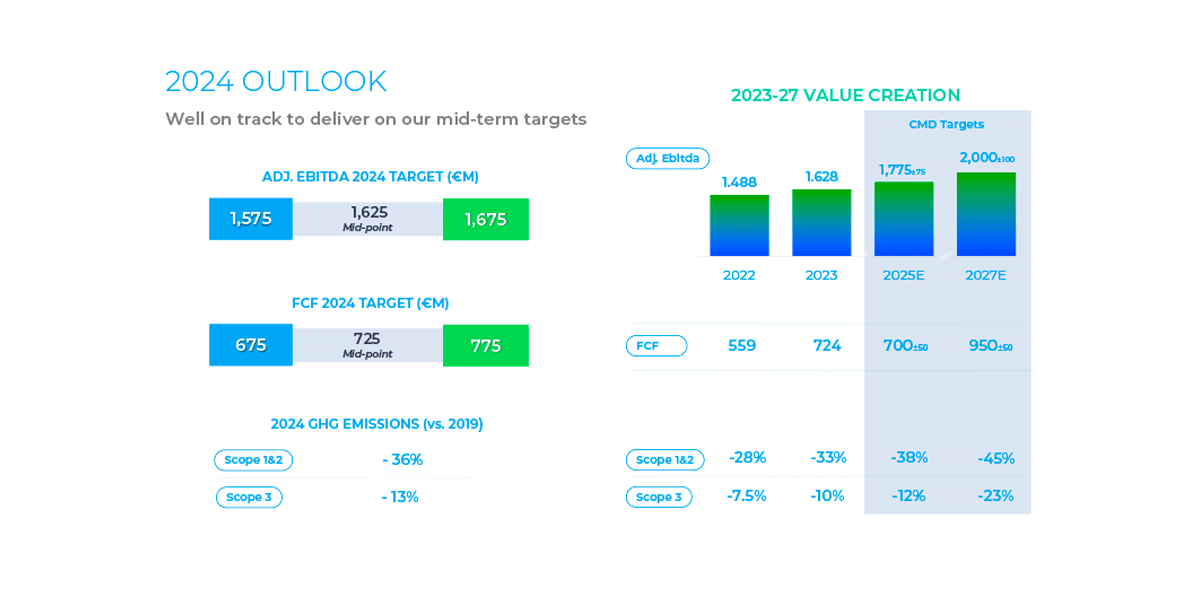

For FY 2024, Prysmian expects to achieve:

- adjusted EBITDA in the range of €1,575-1,675 million

- free cash flow in the range of €675-775 million

- scope 1&2 GHG emission reduction of 36% and Scope 3 reduction of 13% vs 2019

At its Capital Markets Day, held on October 5, 2023, the Group presented its strategy to lead the Energy Transition and Digital Transformation – “Connect, to lead” – thereby outlining 2027 financial targets, consisting of:

- Adj. EBITDA of €2bn (+/-€100m)

- Free Cash Flow to €900m-1bn

- EBITDA conversion in FCF to 47-48%

- ROCE to 25-28%

These goals assume no material changes in both the geopolitical crisis relating to the conflicts in Ukraine and in Israel, in addition to excluding extreme dynamics in the prices of production factors or significant supply chain disruptions. The forecasts are based on the Company's current business perimeter, assuming a EUR/USD exchange rate of 1.08, and do not include impacts on cash flows related to Antitrust issues.