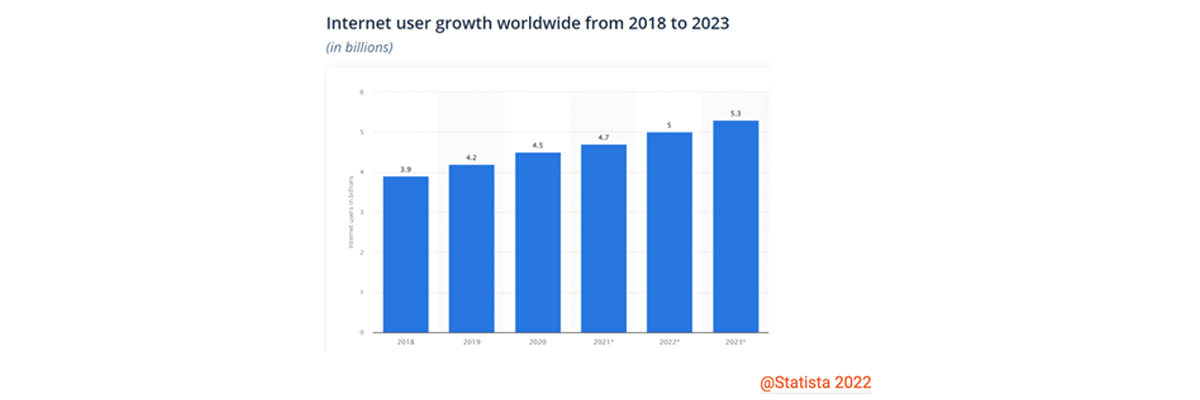

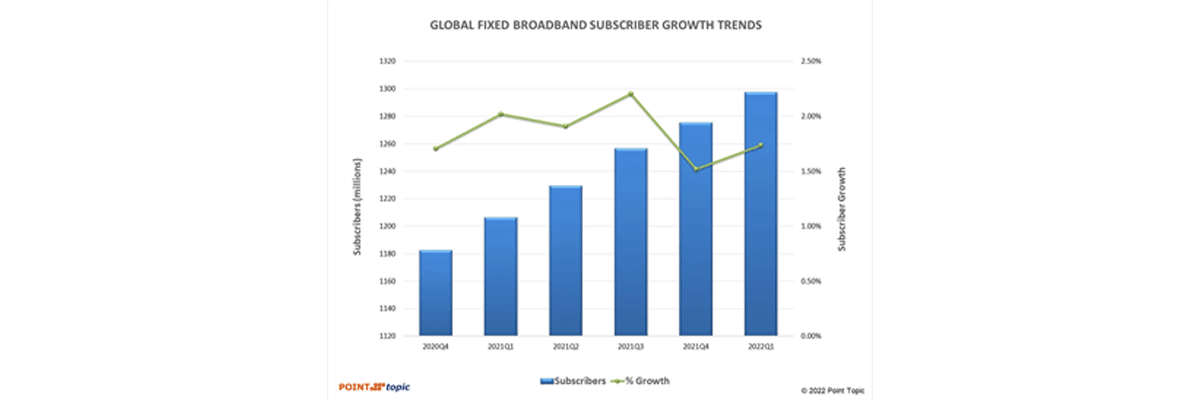

Demand remains solid, especially with an unprecedented level of government funding available for closing the digital divide, as well as increasing AltNet activity and national broadband plans. Fibre broadband continues to attract significant investment capital, according to global strategy and management consulting firm Kearney. Companies in this market continue to see valuations of 16x to 20x EBITDA. Kearney predicts that FWA and satellite will become increasingly ‘niche’ as wireline connections become more widespread. Mobile and broadband subscriptions will continue to rise in 2023, while fixed-line connections will continue their decline, claims the Economist Intelligence Unit. According to Julie Kunstler, Chief Analyst, Broadband Access at Omdia, PON will continue to be the most-deployed fibre-access technology worldwide in 2023.

One especially important consideration: where FTTH used to be the main driver for fibre rollouts, this is no longer the case… Today, fibre is required to enable a wider range of services, technologies and applications than ever: for example, Smart Cities, 4K and 8K video, AR and VR, and cloud computing. The smart home application segment is expected to be an especially profitable market for FTTH. Healthcare offers vast opportunities for IoT technology. The global market for IoT-enabled health devices is set to hit $267 bn by 2023, according to Prescient Strategic Intelligence.