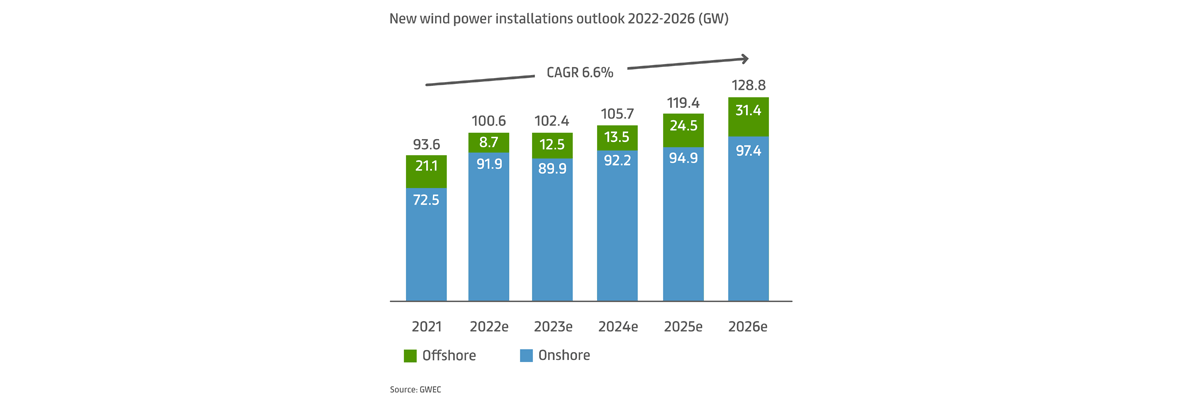

Amongst the positive news, states GWEC, it is important to point out that wind energy needs to grow much faster in order to make the global energy transition possible. At the current rate, GWEC Market Intelligence predicts that by 2030 we will have less than two-thirds of the wind energy capacity required for the 1.5°C and net zero pathway set out by IRENA in their 2050 roadmap.

Wind deployment needs to increase exponentially this decade in order to reach the goal of over 8,000 GW of installed capacity worldwide by 2050. However, in many countries, lack of infrastructure such as grid and transmission networks is limiting growth and innovation. There is also insufficient trained labour capacity. Further issues to be addressed include environmental challenges, resistance from local communities, complex permitting schemes and land acquisition conflicts.

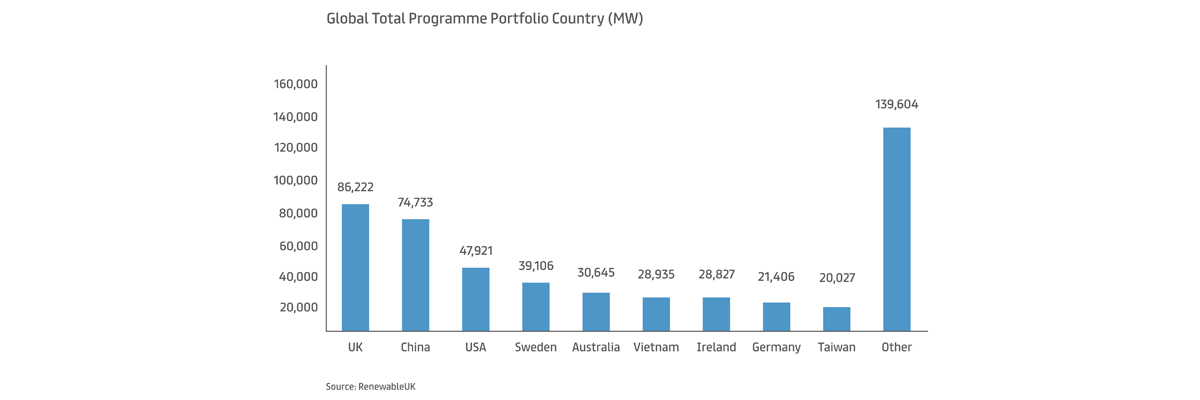

However, overall, government commitments to net zero, renewed urgency for achieving energy security, an increase in the number of companies developing wind projects, and technological progress are driving a positive outlook for offshore wind. However, GWEC points out that action is required to deliver the wind capacity required to reach climate goals. Floating offshore wind is expected to play a key role in delivering this capacity, and large oil and gas companies are playing an important part in developing and commercialising this market, relying on offshore engineering skills.

Floating foundations may become viable for water depths of 1,000 meters and more, increasing the viable sea area for offshore wind by a factor of five. The power rating of wind turbines is also growing significantly. Turbines with a capacity of 15 megawatts and higher are expected to be available within five years. Further advances in floating wind technology and standardization in the coming decade are expected to further boost performance.

Another positive development is the lower Levelized cost of electricity (LCOE) - the price at which generated electricity should be sold for the system to break even at the end of its lifetime. According to IRENA, global weighted-average LCOE for onshore wind dropped $0.04/kWh by 2020 (nearly 60% decline over the past decade) while fixed-bottom offshore wind LCOE reached $0.08/kWh (almost 50% decline).