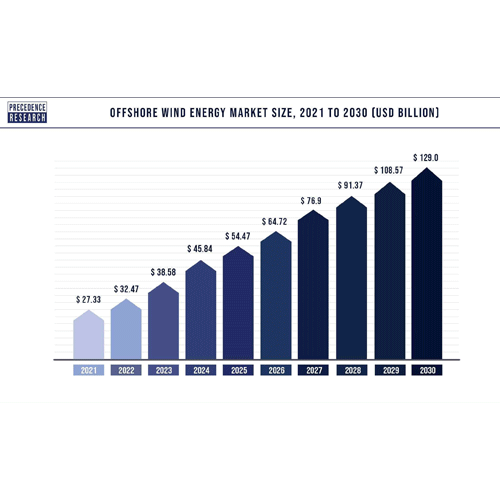

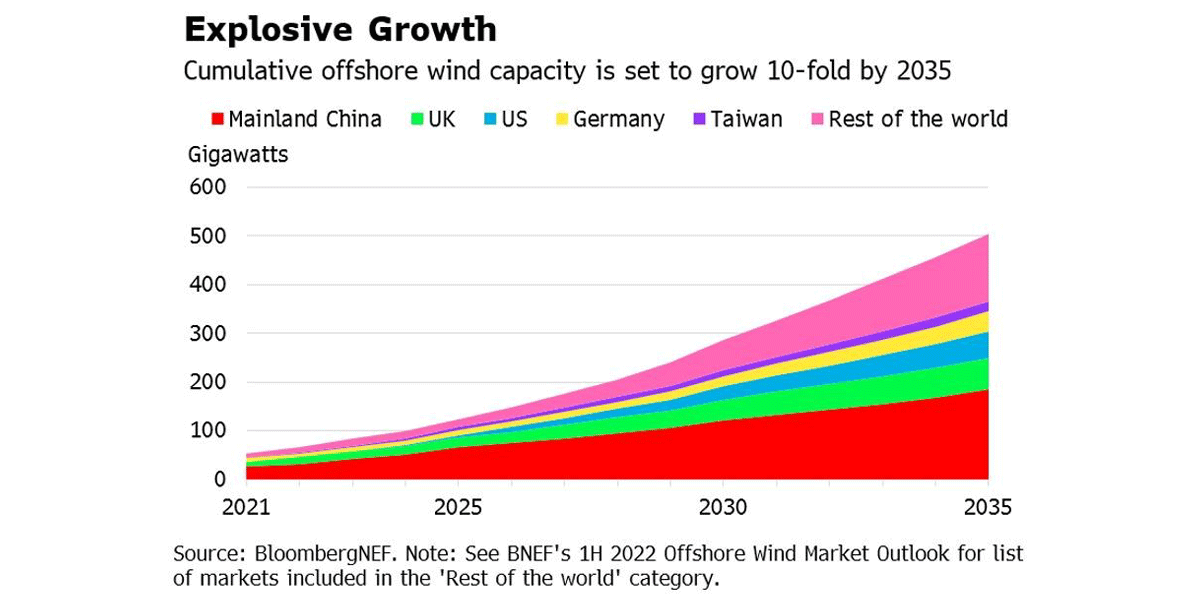

Drivers for this market are very positive and offshore wind is expected to remain strong in all existing markets. Increasing uptake of renewables, and offshore wind in particular, is being driven by policies in the areas of energy transition, environmental protection, and energy security.

The International Energy Agency (IEA) Government Energy Spending Tracker from last December shows that investments in clean energy by nations transitioning to a renewable energy infrastructure exceeded US$ 1.2 trillion since the start of the pandemic. According to IAE, this government spending should stimulate substantial private investment, which could raise global clean energy investment by another 50% to over USD 2 trillion per year in 2030.

In order to achieve ‘net zero’ and limit global temperature increase to 1.5°C IEA and the International Renewable Energy Agency (IRENA) expect offshore wind capacity will need to exceed 2000 GW in 2050, from just over 60 GW today, to Celsius and achieve net zero, which is affecting policies worldwide. At the COP27 last November, nine new countries including Belgium, Colombia, Germany, Ireland, Japan, the Netherlands, Norway, the UK, the US joined the Global Offshore Wind Alliance (GOWA), pledging to ramp up offshore wind rapidly to tackle climate change and energy security issues. According to McKinsey, global installed offshore wind capacity is expected to reach 630 gigawatts (GW) by 2050.